DIGGING IN FOR THE K-WINTER

Like so many of us, Margret Kopala lost a significant portion of her life savings in the stock market crash of 2008. Unlike us, however, she went on a long and intense financial odyssey to find out what caused the losses and what she could do to protect herself in the future.

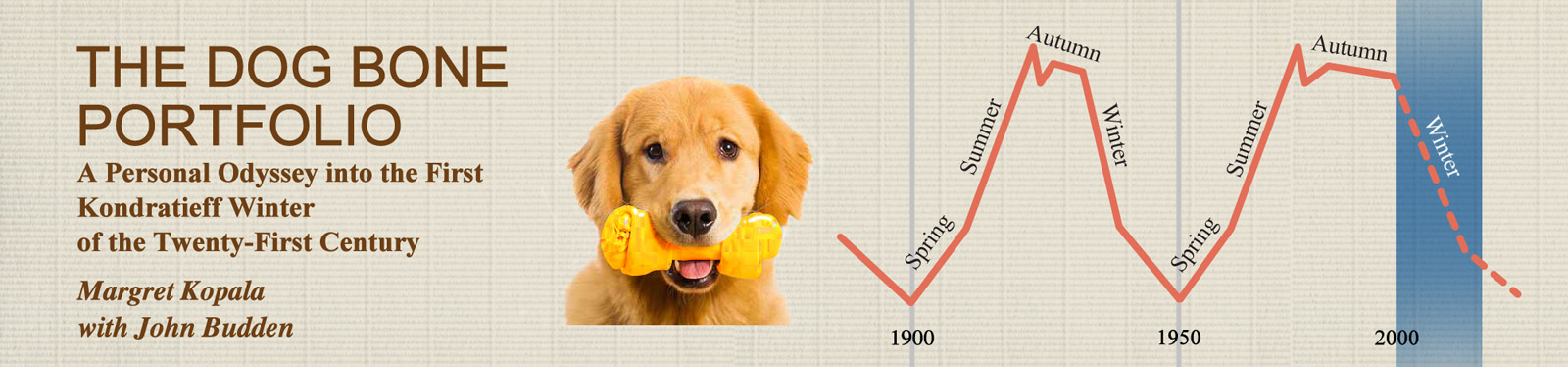

Armed with her skills as a journalist and public policy analyst, fueled by equal measures of fear and determination, and mentored by successful investment strategist and financial broadcaster John Budden, Kopala researched and wrote this magisterial analysis of how Russian economist Nikolai Kondratieff’s long-wave theory is playing out in what many today describe as a financial Winter. Along the way, she is introduced to financial experts familiar with Kondratieff scholarship. John Budden’s interviews with Dean LeBaron, J. Anthony Boeckh, Ian Gordon, Larry Jeddeloh, Don Lindsey, the late Lord William Rees-Mogg, Jim Rogers, Eric Sprott, and Ronald-Peter Stöferle show how investors must put a new spin on asset allocation and security of their assets: like a dog that buries bones in different places, we would be advised to allocate our assets to different parts of the world – and to ensure that a good portion of those assets include gold, the only continuous basis of wealth across history and around the world.

Kopala explores the global, national, and personal effects of:

- overconsumption

- underproduction

- energy and innovation

- the printing of money to “save” the economy

- competitive devaluations

- deflation, reflation and inflation

- war (the ultimate economic crisis)

“like a dog that buries bones in different places, we would be advised to allocate our assets to different parts of the world”

She documents those technologies that seeded previous New Economy Spring seasons – from the era of canals to those of railroads, automobiles, and infotech – and probes today’s innovations most likely to seed the Next New Economy that we desperately need if we are to escape the doldrums of the current financial Winter.

With trenchant explanations of how individuals can achieve portfolio strength by first preserving capital then being vigilant about the financial effects of politics, economic theory, culture, and our own choices, The Dog Bone Portfolio is a gift to investors, policy-makers and, ultimately, nations everywhere.