“The Dog Bone Portfolio will be of timeless use to all careful investors who want to preserve their capital. Reflecting on everything from the relentless pressure of wealth-destroying government policies to the vagaries of long-wave fluctuations in the economy and price levels that are difficult to understand, Margret Kopala and John Budden bring clarity and insight to the forces underlying the great investment issues of the day. These include the role of gold as the proven store of value and the only trustworthy money demonstrated over thousands of years.”

– J. ANTHONY BOECKH, Director of the Graham Boeckh Foundation and former Chairman Bank Credit Analyst Research

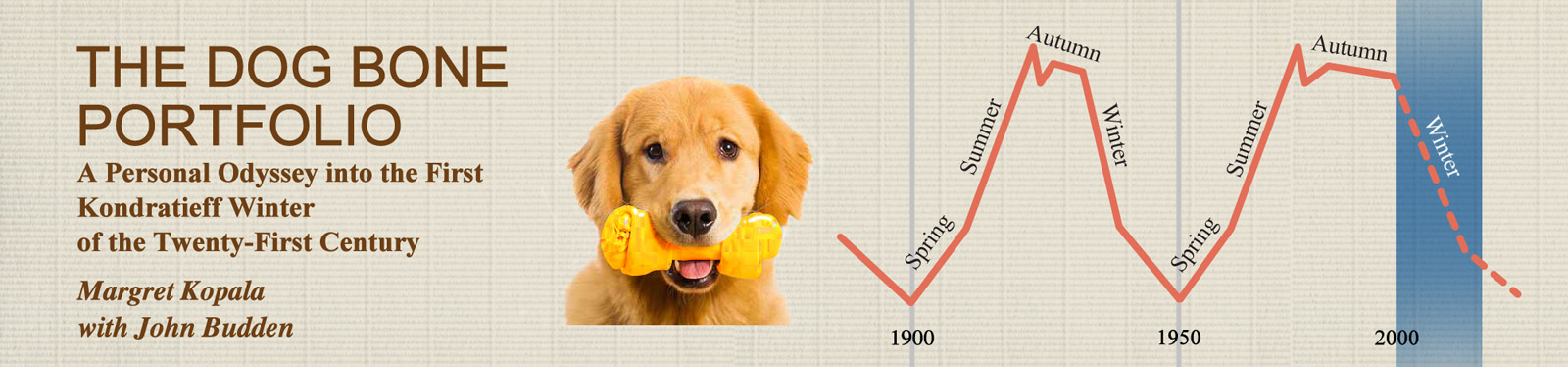

“The ebb and flow of economics was well understood and explained by Nikolai Kondratieff. The period we are in, Winter, by all expectations will be extreme. The Dog Bone Portfolio explains the likely outcomes and the steps you should take to survive.”

– ERIC SPROTT, precious metals specialist and billionaire Founder of Sprott Asset Management

“Kopala and Budden have produced a thorough analysis of the post-2008 economy, an analysis which will be of interest to all those wanting to understand the ‘seasons of capitalism.’”

– PRESTON MANNING, former Leader of the Official Opposition in the Canadian House of Commons

“I am delighted this book recognizes William Rees-Mogg’s contribution to the greater understanding of Kondratieff and more general economic principles. His ceaseless curiosity hovers over its pages.”

– PETER JAY, British Broadcaster, journalist and former UK Ambassador to the United States

“The great Austrian economist Ludwig von Mises once said that an entrepreneur has to be “a historian of the future.” This splendid book provides a holistic view of the markets that will make you a better historian of the future and a more successful manager of your assets. I wish this book the success that it deserves; it is a must read for every prudent investor!”

– RONALD-PETER STOFERLE, Managing Partner, Incrementum AG, Liechtenstein

”The Dog Bone Portfolio uses the example of investment learning from a dog’s behaviour. What could be more contrary? While asset protection is the top priority for the clever bone-burying dog, our canine friend is also open to acquiring new tricks to achieve investment rewards. More than this or any other facet of this book, however, I would emphasize that, while the authors pose the big questions about economics and the future, it is the reader’s task to arrive at answers most valuable to them. This partnership of authors and readers will lead both to successful outcomes. –DEAN LEBARON, Adventure Capitalist