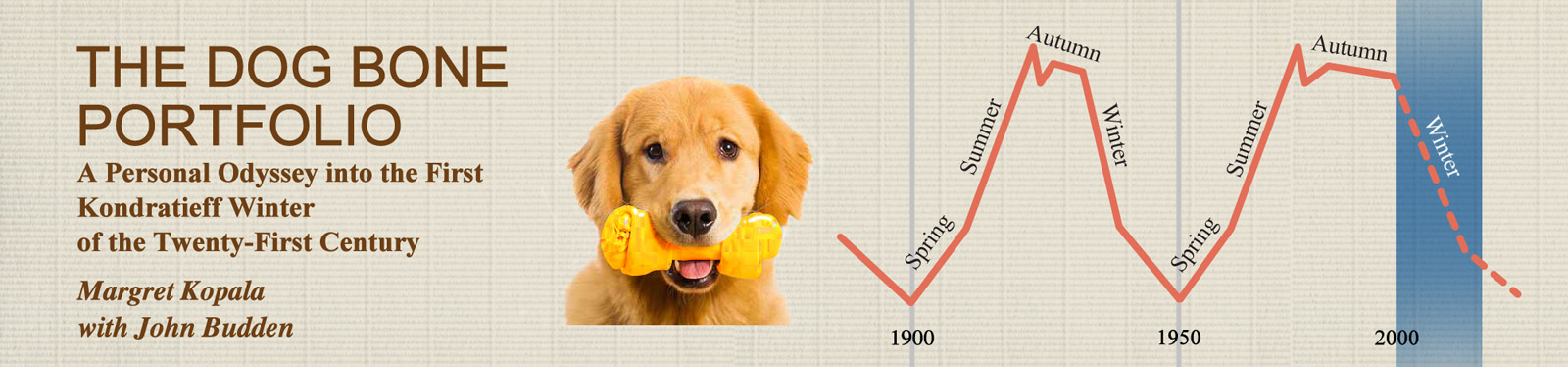

The completion of the current BAAC Supercycle Winter – now in its 16th year, consistent with our original forecast – will complete the current K-Cycle, following which the extremely bullish Supercycle Spring of a new K-Cycle will begin. Our work indicates that in this next Spring, the Dow will reach 50,000 to 100,000 by 2030.

We disagree with this chart’s characterization of the May 2009 to May 2015 stock-market advance as the start of a secular bull market. Rather, it was a cyclical bull market in the ongoing secular bear market of the current Supercycle winter. Note that it was just half the magnitude of the 1932-37 cyclical bull market, which the chart rightly characterizes as part of the secularly bearish stock market of the Supercycle Winter of 1929-49.

This could clearly be seen once that Winter was complete, just as we expect the May 2009-May 2015 cyclical bull market, or Fed-fed Bubble, will come to be viewed, following the end of this Supercycle Winter.

Note also the similarity in the now-concluded cyclical bull market having ended for the same reason the 1932-37 advance did: a “Big Mistake” by the Fed in reversing accommodative monetary policy before the economy was in a self-sustaining expansion – this time, by ending its stimulus (QE3, an economic failure) and increasing its key interest rate.

In the present case, the cyclical bull market culminated in what we were the first to call a “Fed-fed Bubble,” which is now in the process of busting, concurrent with the emerging third U.S. (and now global) recession of this Winter. This is all consistent with our long-standing forecast of a BAAC Supercycle Winter, characterized by three to four more severe recessions accompanying more frequent and severe bear markets.

Our work clearly shows that the current bearish, ultimately deflationary economic period that we term a BAAC Supercycle Winter, which we alone forecasted nearly two decades ago – prior to its start – has not yet ended.

Its third bear market, now underway, is a Supercycle bear market that is the bust of the Fed-fed Bubble, with the drop augmented by the Fed’s Big Mistake. The decline, which started at the stock-market high on May 20, 2015, still has much further to go for our Supercycle stock-market and economic valuation indicators to approach the levels of reversion-to-the-extreme that are particularly characteristic of the end of bearish Supercycle Winters and Summers.

Historically, both Supercycle Summers and Winters have ended at the low of a normal, cyclical bear market that followed the Supercycle bear market in those Seasons. We can expect that the Supercycle bear market now underway will be followed by a normal bear market to complete this Supercycle Winter, just as occurred at the end of the past two Winters (1871-99 and 1929-49) and the past two Summers (1906-21 and 1965-82). This is all the more likely because the recession now emerging is likely to linger on well beyond the end of the Supercycle bear market, as did the recessions associated with the Supercycle bear markets of the earlier Winters and Summers just referenced here.

No comments yet.